The discourse around AI in the workplace typically revolves around two narratives. The first narrative is AI replacing human jobs. The second is humans managing AI systems. However, a more compelling possibility is emerging—AI systems functioning as true colleagues that amplify human capabilities.

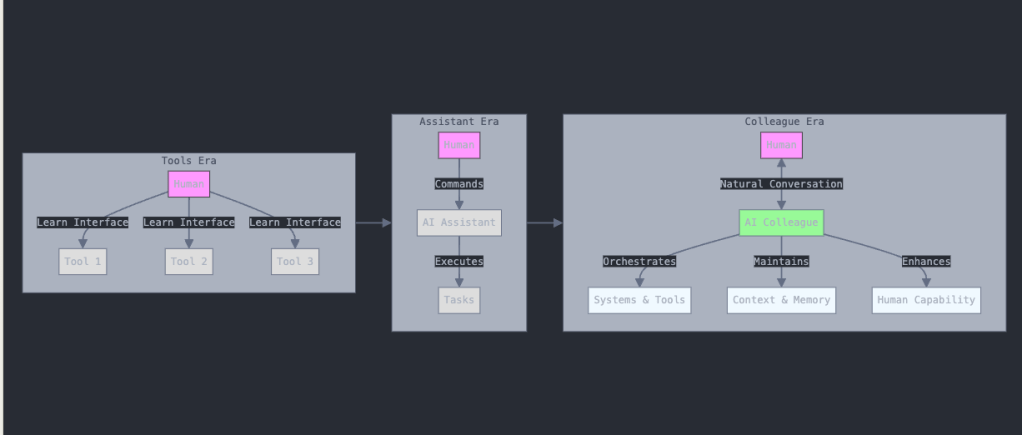

This shift mirrors a clear evolution in how we interact with technology in the workplace. We transitioned from a Tools Era. During this time, each application required learning specific interfaces. Then we went through an Assistant Era of basic command execution. Now, we’re entering what might be called the Colleague Era. In this era, AI systems engage in natural conversation. They orchestrate work and enhance human capabilities.

Consider how effective colleagues improve our work: they don’t simply execute tasks or issue directives. They help refine our thinking, identify blind spots, and maintain momentum across complex projects. Early implementations of this approach are appearing in products like Meter Command and Rox. Here, conversation transcends basic chat functionality. It generates interfaces and orchestrates systems through natural dialogue.

The fundamental insight isn’t technological—it’s relational. The most valuable professional relationships aren’t built on delegation or management but on collaborative enhancement. A true colleague helps you think more clearly while maintaining crucial context across interactions. This suggests a new model for workplace AI. These systems are designed to enhance human capability through natural collaboration. They are supported by sophisticated language models and specialized AI systems working in concert.

The implications extend beyond convenience. Rather than mastering numerous rigid interfaces, we could express intent naturally and let AI colleagues manage complexity. Instead of constant context-switching, we could maintain continuous, productive conversations that orchestrate work seamlessly. Organizations that grasp this paradigm shift won’t merely possess superior tools—they’ll develop fundamentally different capabilities for problem-solving and value creation.

This transition represents a progression from learning interfaces to natural conversation, from executing tasks to orchestrating systems and maintaining context. It’s not just about automation or management—it’s about partnership and growth. And this future is materializing faster than most realize.

The companies that understand and embrace this shift will gain a significant advantage. They won’t just have better tools; they’ll have fundamentally different capabilities for solving problems and creating value. Their teams will work differently. They will think differently. Ultimately, they will achieve outcomes that weren’t possible in the Tools Era or even the Assistant Era.

As we move into this new era, the question to me isn’t whether AI will replace or assist us. Instead, it’s about how we can build true collaborative relationships with AI systems. These systems should enhance our capabilities and transform how we work.